In today’s digital age, convenience and accessibility in financial transactions are paramount. Okay Recharge, a leading name in the world of digital payments, has revolutionized the way users perform various transactions. With an array of services such as AEPS, MATM, DMT, and BBPS, Okay Recharge empowers users to manage their finances efficiently. In this comprehensive guide, we’ll delve into these services and discover how they empower users.

Understanding AEPS (Aadhaar Enabled Payment System)

AEPS, short for Aadhaar Enabled Payment System, is a government initiative that enables users to make financial transactions using their Aadhaar number. Okay Recharge facilitates AEPS transactions, allowing users to check their bank account balance, make deposits, and withdraw funds using their Aadhaar credentials. This service offers a secure and convenient way to access banking services even in remote areas, thus promoting financial inclusion.

Exploring MATM (Micro ATM)

Micro ATMs, commonly referred to as MATMs, are a vital part of financial inclusion efforts in India. These portable devices allow users to perform basic banking functions, such as cash withdrawals and deposits, in areas where traditional ATMs may not be available. Okay Recharge empowers users by providing MATM services, ensuring that individuals in underserved regions have access to basic financial services with ease.

The Role of DMT (Domestic Money Transfer)

Domestic Money Transfer (DMT) is a key feature of digital payments. DMT allows users to send money to family and friends quickly and securely. Okay Recharge offers a reliable and user-friendly platform for DMT, enabling users to transfer money within the country, pay bills, and even receive money from various channels. This service is a game-changer for those who require quick, efficient, and secure fund transfers.

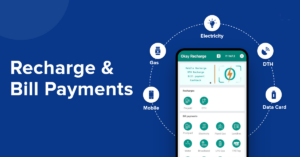

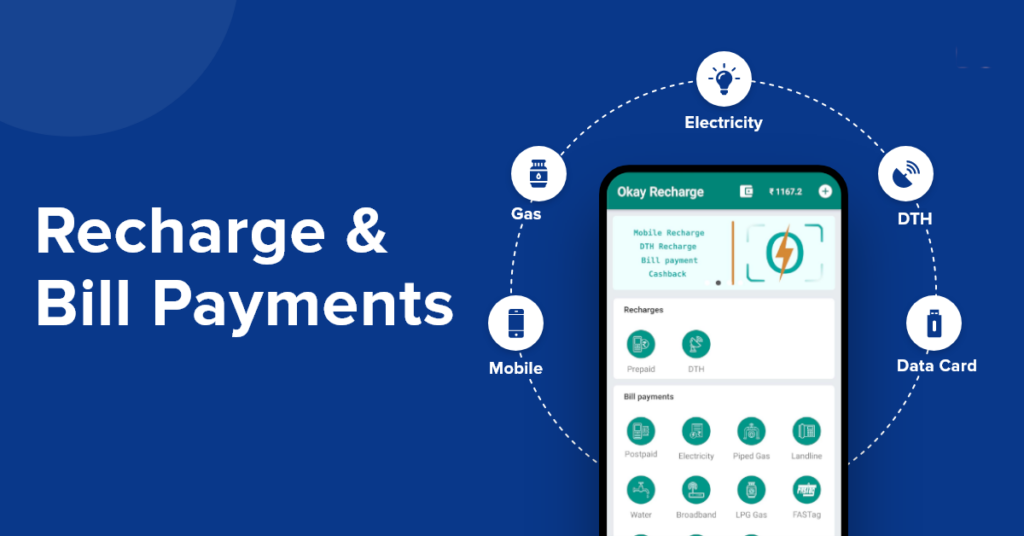

BBPS (Bharat Bill Payment System) for Convenient Bill Payments

Paying utility bills can be a time-consuming and sometimes tedious process. Okay Recharge simplifies this task through its integration with the Bharat Bill Payment System (BBPS). Users can pay their electricity, water, gas, and other bills through the Okay Recharge platform, saving time and ensuring hassle-free bill payments. BBPS empowers users by centralizing bill payments and providing a one-stop solution for managing monthly expenses.

The Okay Recharge Advantage: Accessibility, Convenience, and Security

The strength of Okay Recharge lies in its commitment to providing accessible, convenient, and secure digital payment solutions. By offering services like AEPS, MATM, DMT, and BBPS, the platform empowers users from all walks of life. The advantages of using Okay Recharge include:

- Accessibility: Users can access financial services regardless of their location, bridging the urban-rural divide.

- Convenience: With Okay Recharge, users can make transactions and payments from the comfort of their homes or businesses, reducing the need for physical visits to banks and bill payment centers.

- Security: Okay Recharge prioritizes the security of users’ financial information, ensuring that transactions are protected and encrypted.

Okay Recharge empowers users by simplifying their financial transactions and payments through AEPS, MATM, DMT, and BBPS. This comprehensive guide has shed light on the services offered by Okay Recharge and the benefits they bring to users. With a commitment to financial inclusion, accessibility, and security, Okay Recharge continues to make a positive impact in the world of digital payments.